Pay with Your HSA/FSA Card

Ergo Impact is thrilled to partner with Flex, giving eligible customers the option to use their HSA or FSA accounts. This means you can potentially pay for our products with your HSA or FSA debit card!

Streamlined HSA/FSA Payments with Flex

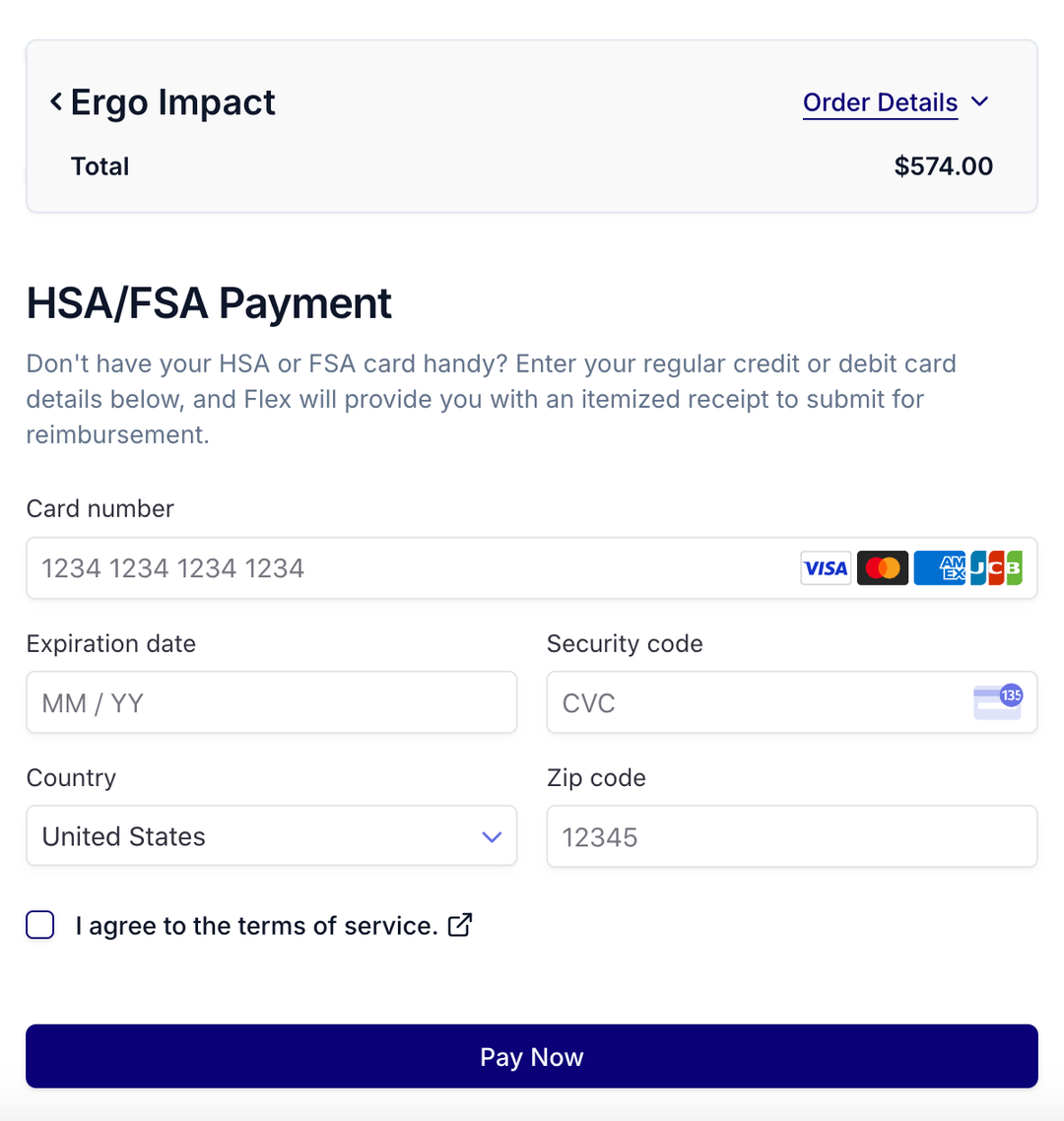

Using your HSA or FSA card is easy! Just add your products to the cart like you normally would. At checkout, pick Flex | Pay with HSA/FSA as your payment method, confirm you're eligible, and enter your HSA or FSA debit card to finish your purchase. No card on hand? No problem! Use your credit card, and Flex will send you an itemized receipt to submit for reimbursement.

How To Use Your HSA/FSA Card

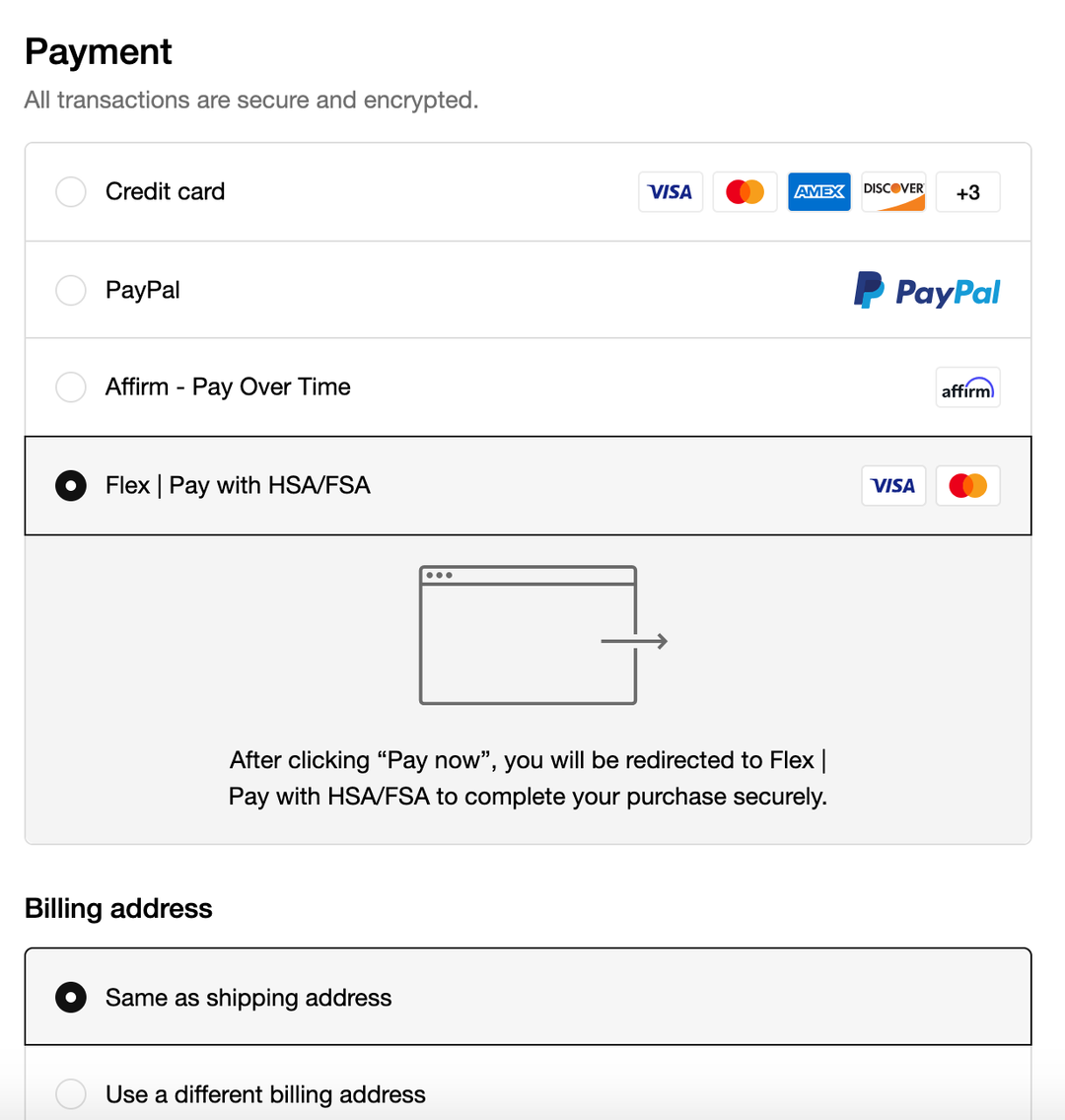

At Checkout Select Flex Pay

Once you've picked your products, just choose Flex | Pay with HSA/FSA at checkout!

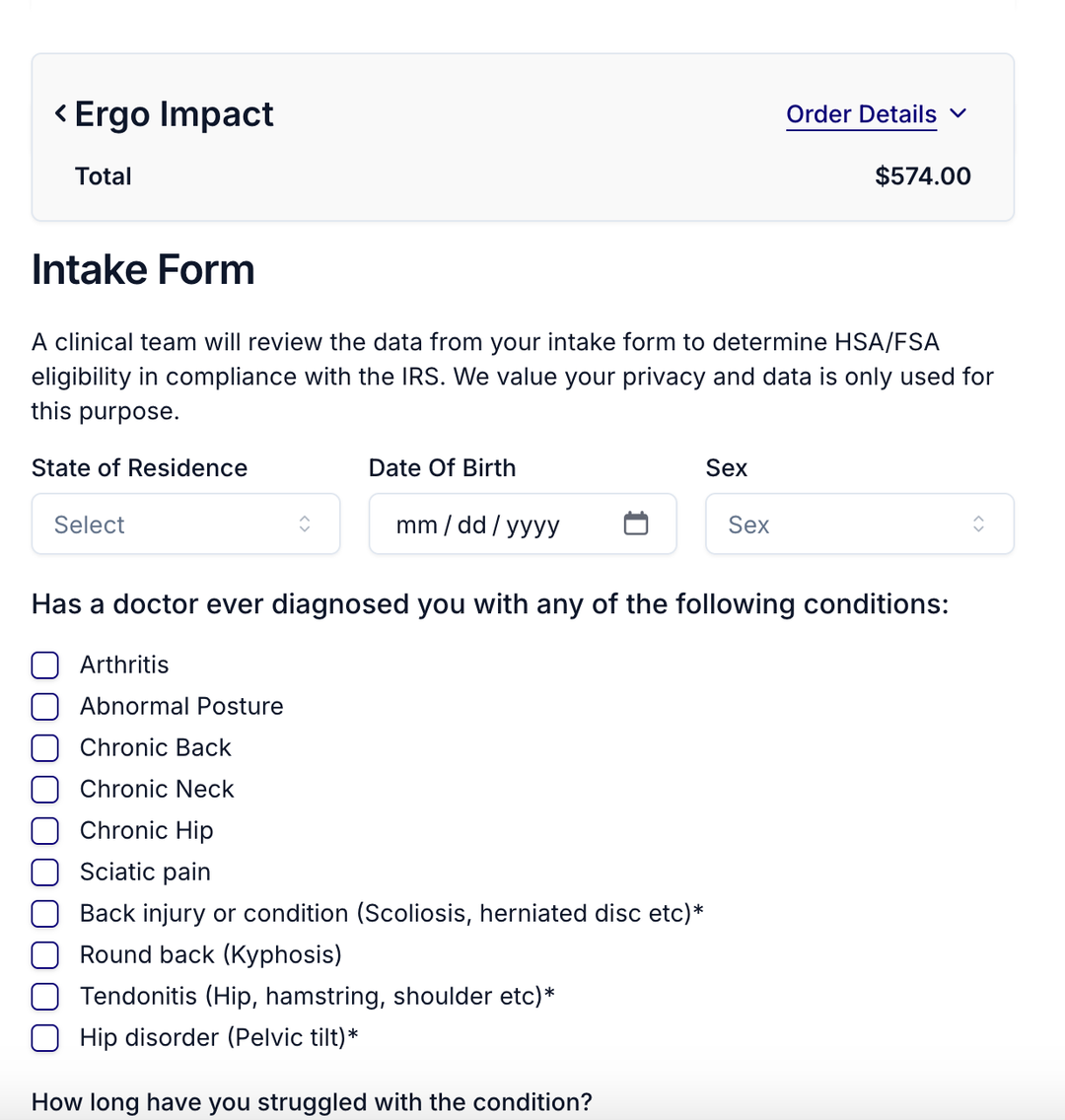

Fill Out The Intake Form

Just fill out the Flex intake form to confirm you're eligible!

Enter Your HSA/FSA Details

Finally, just enter your HSA/FSA card details, click pay, and we’ll get your order shipped out to you!

FAQs

An FSA (Flexible Spending Account) and an HSA (Health Savings Account) are both tax-advantaged accounts designed to cover medical expenses, but they have some key differences. FSAs are employer-sponsored accounts that let you use pre-tax dollars for things like prescriptions and copays. However, they often come with a "use-it-or-lose-it" rule, meaning you need to spend the funds within the plan year. On the other hand, HSAs are available to those with high-deductible health plans and offer more flexibility—your funds can roll over year after year.

If you're being redirected to Shop Pay, try opening an incognito window to complete your purchase using your HSA/FSA card.

Just like any other card, HSA and FSA cards can be declined if there's an issue with the card details, like the number, expiration date, or zip code. Flex will let you know during checkout if anything needs to be updated.

The most common reason for a decline is insufficient funds. Before trying your purchase again, check with your HSA or FSA provider to make sure you have enough funds in your account.

A Letter of Medical Necessity (LOMN) is a note from your healthcare provider that details why a particular medical service, treatment, or equipment is essential for your health. If you're using an HSA (Health Savings Account) or FSA (Flexible Spending Account), you might need an LOMN to get reimbursed for expenses that aren't explicitly listed as eligible by the IRS guidelines.

Flex has joined forces with Ergo Impact to make it easier for you to use your HSA/FSA funds for your purchases.